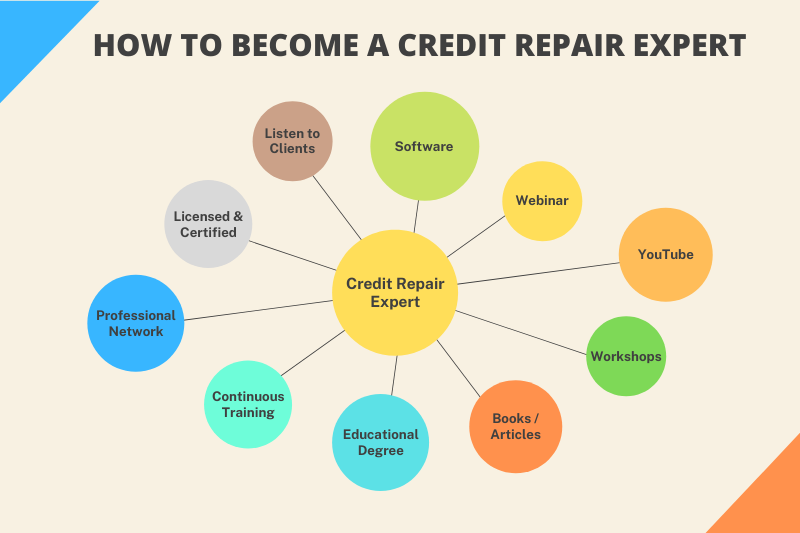

How do I become a credit repair specialist? It’s a question that sparks curiosity in those seeking to help others navigate the complexities of credit repair. Credit repair specialists play a crucial role in empowering individuals to improve their financial well-being by addressing credit issues and building a positive credit history.

This guide provides a comprehensive roadmap to becoming a successful credit repair specialist, covering everything from essential education and certifications to building a thriving business.

From understanding the intricacies of credit repair to mastering effective communication strategies, this guide equips you with the knowledge and skills necessary to excel in this rewarding field. Whether you’re a seasoned professional looking to expand your expertise or an aspiring entrepreneur seeking a fulfilling career path, this comprehensive resource offers invaluable insights and practical guidance.

Understanding Credit Repair

Yo, so you’re thinking about becoming a credit repair specialist? That’s a pretty cool career choice, and it’s definitely in demand these days. But before you jump into it, let’s break down what it’s all about.

Role of a Credit Repair Specialist

Credit repair specialists are like financial superheroes who help people clean up their credit reports and improve their credit scores. They’re basically credit detectives who dive into your credit history, uncover any errors or inaccuracies, and fight to get them removed.

Think of them as your credit score’s personal trainers, guiding you towards a healthier financial future.

Common Credit Issues Addressed

Credit repair specialists deal with a whole range of credit issues, from simple mistakes to more complex problems. Here’s a rundown of some common issues they address:

- Mistaken Identities:This happens when someone else’s credit information is mistakenly linked to your account, which can mess up your score.

- Incorrect Account Information:This could include things like incorrect balances, late payments, or accounts that shouldn’t even be on your report.

- Collection Accounts:When you fail to pay a debt, it can go to collections, which can seriously damage your credit.

- Negative Public Records:These include bankruptcies, foreclosures, and judgments, which can have a major impact on your credit score.

- Fraudulent Accounts:Sometimes, people open accounts in your name without your permission, which can really mess up your credit.

Credit Repair Services Offered

Credit repair specialists offer a variety of services to help you get your credit back on track. Some of the most common services include:

- Credit Report Review:They’ll go through your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify any errors or inaccuracies.

- Dispute Resolution:They’ll help you dispute any incorrect information on your credit reports with the credit bureaus.

- Credit Monitoring:They can monitor your credit reports for any suspicious activity or changes.

- Financial Counseling:They can provide you with advice on how to manage your finances and improve your credit score.

- Debt Negotiation:They can negotiate with your creditors to lower your debt or reduce your interest rates.

Education and Certification

Becoming a credit repair specialist doesn’t require a specific degree, but having the right education and certifications can give you a leg up in the industry. These credentials can demonstrate your knowledge, build trust with clients, and potentially open doors to better opportunities.

Relevant Certifications

Obtaining relevant certifications is a smart move for anyone looking to establish themselves as a credit repair specialist. These certifications show clients you’re committed to learning and staying up-to-date on industry best practices.

- Certified Credit Repair Specialist (CCRS):Offered by the National Association of Credit Services Organizations (NACSO), this certification is recognized as a gold standard in the industry. It demonstrates your understanding of credit laws, ethical practices, and effective credit repair strategies. You’ll need to pass an exam and meet certain experience requirements to earn this certification.

- Certified Financial Education Instructor (CFEI):This certification, provided by the National Endowment for Financial Education (NEFE), focuses on financial education and counseling. It can be valuable for credit repair specialists who want to expand their services and offer broader financial advice to clients.

Resources for Training

Finding the right training program is crucial to acquiring the knowledge and skills needed to succeed as a credit repair specialist. There are various resources available, both online and offline, that can equip you with the necessary expertise.

- National Association of Credit Services Organizations (NACSO):This organization offers a comprehensive training program for aspiring credit repair specialists, including the CCRS certification course. They provide a mix of online and in-person training options.

- Credit Repair Organizations of America (CROA):CROA offers training programs and resources for credit repair specialists, covering topics like credit laws, ethical practices, and effective credit repair strategies.

- Online Courses and Programs:Numerous online platforms offer courses and programs specifically designed for credit repair specialists. These platforms provide flexibility and convenience, allowing you to learn at your own pace.

Legal and Ethical Considerations

Credit repair is a serious business with significant legal and ethical implications. Understanding these aspects is crucial for anyone considering a career in this field. Navigating the legal framework and adhering to ethical guidelines ensures you operate within the bounds of the law and maintain professional integrity.

Legal Framework for Credit Repair

The legal framework surrounding credit repair is designed to protect consumers from unethical practices. The Credit Repair Organizations Act (CROA) is the primary federal law regulating credit repair. It defines credit repair organizations and Artikels their responsibilities, rights, and restrictions.

- Registration with the FTC:Credit repair organizations must register with the Federal Trade Commission (FTC) and provide specific information, including their business practices and fees.

- Prohibited Practices:The CROA prohibits credit repair organizations from making false or misleading statements, charging upfront fees, or guaranteeing results. They must also disclose the client’s rights and responsibilities.

- Client Agreements:Credit repair organizations must provide clients with written contracts detailing the services they offer, the fees involved, and the time frame for completing the services.

- Cancellation Rights:Clients have the right to cancel their credit repair contract within three business days of signing it, without any penalty.

Ethical Guidelines for Credit Repair Specialists

Ethical practices are paramount in credit repair. Maintaining ethical standards builds trust with clients and strengthens the reputation of the industry. Here are some key ethical guidelines for credit repair specialists:

- Transparency:Be transparent about your services, fees, and limitations. Avoid making false or misleading promises about the results.

- Client Confidentiality:Maintain strict confidentiality of client information and protect it from unauthorized access.

- Honesty and Integrity:Be honest and upfront with clients about their credit situation, potential solutions, and the time frame for achieving results.

- Client Education:Educate clients about their credit rights and responsibilities, and empower them to make informed decisions about their credit.

- Professionalism:Maintain a professional demeanor and conduct business with integrity.

Checklist for Ethical Practices

To ensure ethical practices, consider this checklist:

- Do you fully disclose all fees and charges upfront?

- Do you provide clients with a written contract detailing the services you offer?

- Do you avoid making false or misleading promises about the results?

- Do you respect client confidentiality and protect their personal information?

- Do you provide clients with accurate and up-to-date information about their credit?

- Do you educate clients about their credit rights and responsibilities?

- Do you handle disputes and complaints professionally and fairly?

Business Setup and Operations

Setting up a credit repair business requires careful planning and execution. From legal requirements to marketing strategies, you need to be prepared for the challenges and rewards of helping others achieve financial stability.

Starting a Credit Repair Business

Before you dive into the exciting world of credit repair, you need to get your ducks in a row. This involves several essential steps:

- Legal Requirements:Check with your state’s licensing requirements for credit repair organizations. Some states require specific licenses, while others may only need registration or notification. You may also need to obtain a business license and comply with federal laws like the Fair Credit Reporting Act (FCRA).

- Business Structure:Decide on the legal structure of your business, such as a sole proprietorship, partnership, LLC, or corporation. This will impact your liability, taxes, and administrative requirements.

- Business Plan:Create a detailed business plan outlining your services, target market, marketing strategy, financial projections, and operational procedures. A well-structured business plan is crucial for securing funding, attracting investors, and guiding your business decisions.

- Insurance:Consider obtaining professional liability insurance to protect your business from potential claims related to errors or omissions in your services.

Essential Business Tools and Software

Having the right tools and software can streamline your credit repair operations and enhance your efficiency.

- Credit Reporting Software:This software helps you access and analyze credit reports, identify errors, and track progress for your clients. Some popular options include Credit Repair Cloud, Credit Manager, and Credit Sesame.

- Customer Relationship Management (CRM) Software:A CRM system helps you manage client interactions, track communication, schedule appointments, and organize client data. Popular choices include Salesforce, HubSpot, and Zoho CRM.

- Document Management Software:This software helps you store and manage client documents securely, including credit reports, dispute letters, and other relevant files. Some options include Dropbox, Google Drive, and Microsoft OneDrive.

- Accounting Software:This software helps you manage your finances, track income and expenses, generate invoices, and prepare tax reports. Popular choices include QuickBooks, Xero, and FreshBooks.

Marketing Strategies for Attracting Clients

Once you have your business set up, it’s time to attract clients. Here are some effective marketing strategies:

- Website and Online Presence:Create a professional website that showcases your services, qualifications, and testimonials. Use search engine optimization () to improve your website’s visibility in search results. Utilize social media platforms like Facebook, Instagram, and LinkedIn to connect with potential clients and build your brand awareness.

- Networking and Referral Programs:Attend industry events, connect with other professionals, and build relationships with potential referral sources. Implement a referral program to incentivize existing clients to recommend your services to their network.

- Content Marketing:Create valuable content, such as blog posts, articles, and videos, that educate consumers about credit repair and the benefits of your services. Share this content on your website and social media platforms.

- Paid Advertising:Consider using paid advertising platforms like Google Ads and Facebook Ads to reach a wider audience. Target your ads to specific demographics and interests to maximize your return on investment.

Client Interaction and Communication

Building trust and rapport with clients is crucial in the credit repair industry. Effective communication is key to establishing a strong foundation for a successful client relationship.

Effective Communication Techniques

Effective communication is the backbone of any successful credit repair specialist’s practice. It’s about more than just delivering information; it’s about building trust and understanding with clients. Here are some key techniques:

- Active Listening:Pay close attention to what your clients are saying, both verbally and nonverbally. Ask clarifying questions to ensure you understand their concerns and goals.

- Clear and Concise Language:Use plain language that your clients can easily understand. Avoid jargon or technical terms that might confuse them.

- Empathy and Understanding:Put yourself in your clients’ shoes and try to understand their frustration and anxiety about their credit situation. Show genuine empathy and let them know you’re there to help.

- Regular Updates:Keep your clients informed about the progress of their credit repair plan. Provide regular updates, even if there’s no significant change, to maintain transparency and build trust.

- Respond Promptly:Respond to client inquiries and concerns promptly. A quick response demonstrates professionalism and shows that you value their time.

Client Intake Forms and Agreements

A well-structured client intake form and agreement are essential for establishing clear expectations and legal protection.

- Client Intake Form:This form should gather essential information about your clients, including their personal details, credit history, goals, and financial situation.

- Client Agreement:This document Artikels the terms of service, including the scope of services, fees, payment schedule, and client responsibilities. It’s crucial to have a clear understanding of your responsibilities and limitations as a credit repair specialist.

Here’s a template for a client intake form and agreement:

Client Intake Form Template

| Section | Description |

|---|---|

| Personal Information | Name, Address, Phone Number, Email Address |

| Credit History | Credit Score, Credit Report Summary, Outstanding Debts, Previous Credit Repair Attempts |

| Financial Situation | Income, Expenses, Debt-to-Income Ratio |

| Goals | Desired Credit Score, Timeframe for Improvement, Specific Credit Issues to Address |

Client Agreement Template

| Section | Description |

|---|---|

| Scope of Services | Detailed list of services to be provided, including credit dispute letters, credit monitoring, and financial counseling. |

| Fees and Payment Schedule | Clear breakdown of fees, payment schedule, and payment methods. |

| Client Responsibilities | Artikel of client responsibilities, such as providing accurate information, responding to inquiries, and following instructions. |

| Confidentiality | Statement regarding the confidentiality of client information. |

| Termination | Conditions for terminating the agreement, including client cancellation and breach of contract. |

| Disclaimers | Statements regarding the limitations of credit repair services and the potential for results to vary. |

Managing Client Expectations

Managing client expectations is vital for building a long-term relationship. Clear and honest communication is key.

- Set Realistic Expectations:Explain that credit repair takes time and effort, and results may vary depending on individual circumstances.

- Educate Clients About the Process:Provide clear explanations about how the credit repair process works, including the steps involved, the potential challenges, and the timeframe for improvement.

- Provide Regular Updates:Keep clients informed about the progress of their credit repair plan. Provide regular updates, even if there’s no significant change, to maintain transparency and build trust.

- Address Concerns Promptly:Respond to client inquiries and concerns promptly. A quick response demonstrates professionalism and shows that you value their time.

- Be Transparent About Limitations:Acknowledge the limitations of credit repair services and the potential for results to vary. Don’t make unrealistic promises or guarantees.

Credit Repair Strategies: How Do I Become A Credit Repair Specialist

Credit repair strategies are the specific methods and techniques that credit repair specialists use to improve their clients’ credit scores. These strategies aim to address negative credit history items, such as late payments, collections, and charge-offs, and ultimately help clients achieve better financial standing.

Dispute Inaccurate Information, How do i become a credit repair specialist

Dispute inaccurate information is a common and effective credit repair strategy. It involves reviewing credit reports for errors and challenging them with the credit bureaus.

- Incorrect Personal Information:This includes errors in names, addresses, Social Security numbers, or account numbers.

- Duplicate Accounts:This refers to accounts listed twice on the credit report, which can inflate debt and lower credit scores.

- Closed Accounts Listed as Open:This can negatively impact credit utilization, leading to a lower score.

- Debt Amounts:Incorrect debt balances can lead to a distorted view of the client’s financial situation.

- Late Payments:Incorrectly reported late payments can significantly damage credit scores.

Negotiate with Creditors

Negotiating with creditors is another crucial credit repair strategy. This involves contacting creditors to discuss ways to resolve outstanding debts and potentially improve credit scores.

- Debt Settlement:This involves negotiating a lower amount to settle the debt in full, which can reduce the overall debt owed and improve credit scores.

- Payment Plans:Setting up payment plans can help clients manage their debt more effectively, avoiding further late payments and improving their credit history.

- Removal of Negative Marks:In some cases, creditors may agree to remove negative marks from credit reports if the client has a history of consistent payments.

Credit Counseling and Education

Credit counseling and education play a significant role in credit repair. This involves providing clients with financial literacy and guidance on responsible credit management.

- Budgeting:Helping clients develop a budget can improve their financial stability and reduce the risk of falling behind on payments.

- Debt Management Strategies:Providing clients with strategies for managing debt, such as debt consolidation or balance transfers, can help them improve their credit scores.

- Credit Monitoring:Encouraging clients to monitor their credit reports regularly can help them identify and address errors promptly.

Legal and Ethical Considerations

Credit repair specialists must adhere to legal and ethical guidelines when implementing credit repair strategies. This includes avoiding deceptive practices, such as promising unrealistic results or charging excessive fees.

- Fair Credit Reporting Act (FCRA):The FCRA Artikels the rights of consumers and the responsibilities of credit reporting agencies.

- Credit Repair Organizations Act (CROA):The CROA regulates credit repair organizations and prohibits certain deceptive practices.

- Truth in Lending Act (TILA):The TILA protects consumers from unfair lending practices and requires lenders to disclose the terms of loans clearly.

Building a Successful Credit Repair Business

A successful credit repair business is built on a solid foundation of trust, expertise, and ethical practices. It’s not just about helping clients improve their credit scores; it’s about building long-term relationships and becoming a trusted advisor in their financial journey.

Building a Strong Reputation

Establishing a strong reputation in the credit repair industry is crucial for attracting clients and building trust. Here are some key strategies:

- Obtain Necessary Certifications and Licenses:Demonstrate your commitment to professionalism by obtaining relevant certifications, such as the Certified Credit Repair Specialist (CCRS) certification offered by the National Association of Credit Services Organizations (NACSO).

- Join Professional Organizations:Networking with other credit repair professionals through organizations like NACSO can provide valuable insights, resources, and opportunities for professional development.

- Build a Strong Online Presence:Create a professional website and maintain active social media profiles to showcase your expertise and connect with potential clients.

- Gather Testimonials and Reviews:Encourage satisfied clients to provide testimonials and reviews, which can be powerful tools for building credibility and attracting new clients.

- Offer Excellent Customer Service:Provide prompt, personalized, and informative communication to build strong relationships with clients and foster trust.

Professional Development and Ongoing Learning

The credit repair industry is constantly evolving, so it’s essential to stay up-to-date on the latest laws, regulations, and best practices.

- Attend Industry Conferences and Workshops:Participate in industry events to learn about new trends, strategies, and legal updates.

- Read Industry Publications and Blogs:Stay informed about industry news and best practices by reading articles, blogs, and newsletters from reputable sources.

- Network with Other Professionals:Engage in conversations with other credit repair specialists to exchange ideas, learn from their experiences, and stay connected to the industry.

Strategies for Sustainable and Profitable Growth

Building a sustainable and profitable credit repair business requires a strategic approach to client acquisition, service delivery, and financial management.

- Develop a Strong Marketing Plan:Target your marketing efforts towards specific demographics and needs, utilizing a combination of online and offline strategies.

- Offer Value-Added Services:Consider expanding your services to include financial education, budgeting advice, and debt management counseling, which can attract clients and enhance your business value.

- Implement Efficient Operations:Streamline your processes, utilize technology to automate tasks, and ensure efficient communication and client management.

- Monitor and Analyze Financial Performance:Track your revenue, expenses, and profitability to identify areas for improvement and make informed business decisions.

End of Discussion

Becoming a credit repair specialist is a journey that requires dedication, ethical conduct, and a genuine desire to help others. By acquiring the necessary knowledge, certifications, and business acumen, you can embark on a fulfilling career path that makes a real difference in the lives of your clients.

Remember, the journey to becoming a credit repair specialist is a rewarding one, offering the opportunity to empower individuals to achieve financial stability and build a brighter future.

Question Bank

What are the typical salaries for credit repair specialists?

Salaries for credit repair specialists can vary depending on experience, location, and the size of the business. On average, credit repair specialists can earn between $30,000 and $60,000 per year. Some specialists who have built successful businesses may earn significantly more.

Is there a specific degree required to become a credit repair specialist?

While a specific degree is not mandatory, having a background in finance, business, or law can be beneficial. Many credit repair specialists have degrees in these fields or possess relevant experience in the financial services industry. However, the most important qualifications are a strong understanding of credit laws, ethical practices, and effective communication skills.

Are there any specific software or tools recommended for credit repair specialists?

Several software and tools can assist credit repair specialists in their work. These include credit reporting software, client management systems, and communication platforms. It’s essential to choose software that meets the specific needs of your business and complies with industry regulations.