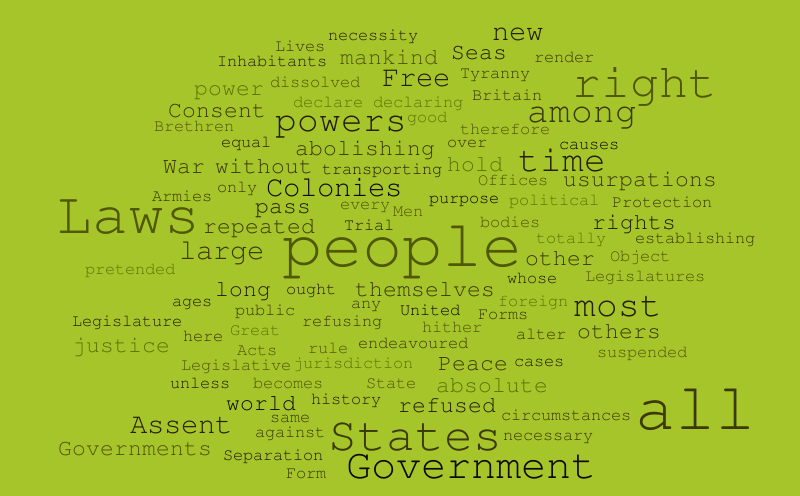

Can a repo man go on private property? This question often arises when a vehicle is repossessed, sparking debate about the rights of property owners and repossession agents. The legal framework governing repossession in the United States is complex, balancing the rights of creditors with the rights of individuals to privacy and property.

Understanding the legal boundaries surrounding repossession on private property is crucial for both parties involved, as unauthorized entry can have serious consequences.

Repossession agents operate under strict legal guidelines that dictate how they can recover vehicles or other assets. While they have the right to repossess property, this right is not absolute and is subject to limitations. The concept of “peaceful repossession” plays a key role, requiring agents to avoid any actions that could lead to violence or damage.

The legal precedents related to repossession on private property are varied, offering insights into the complexities of this issue.

Legal Boundaries of Repossession

Repossession, the process by which a lender takes back collateral due to a borrower’s default on a loan, is a complex legal procedure with specific rules and limitations. Understanding these boundaries is crucial for both lenders and borrowers, ensuring the process is conducted fairly and legally.

Legal Framework of Repossession in the United States

The legal framework governing repossession in the United States is primarily based on state law, with federal laws providing some overarching guidelines. Each state has its own set of statutes and case law that governs repossession, particularly concerning the methods and procedures involved.

- The Uniform Commercial Code (UCC), a set of commercial laws adopted by all states, provides a general framework for secured transactions, including repossession. The UCC Artikels the rights and duties of both secured creditors and debtors.

- The Fair Debt Collection Practices Act (FDCPA) regulates the collection of consumer debts, including repossession activities. It prohibits certain unfair or abusive practices by debt collectors, such as harassment, threats, or false representations.

- The Truth in Lending Act (TILA) requires lenders to disclose specific information about loan terms, including repossession procedures, to borrowers. This transparency helps borrowers understand their rights and obligations.

Key Legal Principles of Repossession

Several key legal principles define the scope of repossession rights, ensuring fairness and legal compliance:

- Right to Peaceful Repossession:Repossession must be conducted peacefully, without resorting to force or violence. This means that the lender cannot break into a borrower’s property, use physical force to remove the collateral, or engage in any actions that could endanger the borrower or others.

- Notice and Opportunity to Cure:In most states, lenders are required to provide borrowers with notice of default and an opportunity to cure the default before initiating repossession. This allows borrowers to make good on their obligations and avoid the loss of their collateral.

- Right to Due Process:The Fifth and Fourteenth Amendments to the United States Constitution guarantee due process of law, meaning that borrowers have the right to a fair hearing before their property can be taken away. This includes the right to notice of the repossession action and the opportunity to challenge it in court.

- Breach of the Peace:Repossession actions that involve force or violence, or that threaten the borrower’s safety, can be considered a breach of the peace. In such cases, the repossession may be illegal, and the borrower may have grounds to sue the lender.

Peaceful Repossession and Private Property

The concept of “peaceful repossession” is particularly relevant when it comes to repossessing collateral located on private property. Lenders generally cannot enter private property without the owner’s consent to repossess collateral. However, there are exceptions to this rule:

- Consent:If the borrower consents to the repossession, the lender can enter the property to take possession of the collateral. This consent can be expressed, such as through a signed agreement, or implied, such as by the borrower allowing the lender access to the property.

- Open and Obvious:If the collateral is open and obvious, such as a car parked in a driveway, the lender may be able to repossess it without entering the property. However, the lender must still avoid any actions that could be considered a breach of the peace.

- Abandoned Property:If the collateral is abandoned on the property, the lender may be able to repossess it without entering the property. However, the lender must be able to demonstrate that the property was indeed abandoned.

Legal Precedents on Repossession on Private Property

Several legal precedents illustrate the application of peaceful repossession principles on private property:

- Williams v. Walker-Thomas Furniture Co.(1965): This case involved a furniture store that repossessed all of a customer’s purchases when she defaulted on one payment, despite the fact that the customer had paid more than half the price of the furniture. The court ruled that the repossession was unconscionable and violated the customer’s right to due process.

This case established the principle that repossession must be fair and reasonable, and that lenders cannot use unfair or oppressive tactics to take back collateral.

- The Peoples Bank & Trust Co. v. City of Dandridge(1970): This case involved a bank that repossessed a building that was used as a bank branch. The bank attempted to repossess the building without obtaining a court order, which violated the borrower’s right to due process. The court ruled that the bank’s actions were illegal and ordered the bank to return the building to the borrower.

Private Property Rights and Repossession

The right to own and use private property is a fundamental principle in many legal systems. However, this right is not absolute and can be subject to limitations, particularly in the context of repossession. Repossession agents, acting on behalf of lenders, have specific legal rights to recover collateral, but these rights must be exercised within the bounds of the law, respecting the property rights of the owner.

Trespass and Repossession on Private Property

Trespass is a legal term that refers to the unauthorized entry onto another person’s property. In the context of repossession, a repossession agent entering private property without permission could be considered trespassing. The concept of “trespass” is important because it defines the limits of a repossession agent’s authority and the potential consequences of exceeding those limits.The following are some examples of situations where repossession on private property might be considered trespassing:

- A repossession agent enters a private residence without a court order or the owner’s consent.

- A repossession agent enters a private property through a locked gate or by breaking a window.

- A repossession agent enters a private property to repossess an item that is not located on the property, but is stored there temporarily.

Here is a hypothetical scenario where a repossession agent enters private property without permission:

Imagine a repossession agent is tasked with recovering a car that is parked in the driveway of a private residence. The agent arrives at the property and finds the car parked in the driveway. The agent does not have permission from the homeowner to enter the property. The agent proceeds to enter the driveway, opens the car door, and drives the car away. This action could be considered trespassing, as the agent entered the property without permission and interfered with the homeowner’s right to use and enjoy their property.

The Role of Law Enforcement

Law enforcement plays a crucial role in repossession cases, especially when they involve private property. They act as intermediaries between the repossession agent and the debtor, ensuring that the process is conducted legally and peacefully.

Circumstances for Law Enforcement Assistance

Law enforcement may assist repossession agents in specific situations to maintain order and prevent potential conflicts. This assistance is usually provided when:

- The debtor is resisting the repossession or poses a threat to the repossession agent.

- The repossession agent requires access to the property to retrieve the collateral, and the debtor refuses entry.

- The repossession involves a vehicle, and the debtor is obstructing the removal of the vehicle.

Legal Ramifications for Law Enforcement

Law enforcement officers must strictly adhere to legal boundaries and property rights during repossession cases. Any violation of these rights can lead to serious legal consequences, including:

- Civil lawsuits: The debtor can file a civil lawsuit against the officer for unlawful entry, trespass, or damage to property.

- Criminal charges: In extreme cases, officers may face criminal charges for assault, battery, or unlawful seizure.

- Disciplinary action: The officer’s employer, usually the police department, may take disciplinary action, including suspension or termination.

Responsibilities of Law Enforcement in Repossession Cases

| Responsibility | Description |

|---|---|

| Ensure legal process | Verify that the repossession agent has the necessary legal documents, such as a court order or a valid repossession contract. |

| Maintain order | Prevent any violence or disruption during the repossession process. |

| Protect property rights | Ensure that the repossession agent does not damage the debtor’s property or violate their privacy. |

| Facilitate peaceful access | Assist the repossession agent in gaining access to the property to retrieve the collateral, if necessary. |

Repossession Procedures and Best Practices: Can A Repo Man Go On Private Property

![]()

Repossession agents must adhere to specific procedures and best practices to ensure compliance with legal requirements and minimize potential legal issues. Understanding these guidelines is crucial for both repossession agents and individuals facing repossession.

Standard Procedures for Repossession

The standard procedures for repossessing vehicles or other assets vary depending on state laws and the specific terms of the loan agreement. However, there are some general steps that repossession agents typically follow:

- Notice of Default:Before initiating repossession, the lender must typically send a written notice to the borrower informing them of their default on the loan. This notice provides the borrower an opportunity to cure the default and avoid repossession.

- Right to Cure:Depending on the state and loan agreement, the borrower may have a right to cure the default by making the missed payments or bringing the loan current within a specified timeframe. This right to cure must be clearly communicated to the borrower.

- Repossession Authorization:The repossession agent must have proper authorization from the lender to proceed with the repossession. This authorization may be in the form of a written agreement or a specific instruction from the lender.

- Peaceable Repossession:Repossession agents are generally prohibited from using force or violence to take possession of the asset. The repossession must be conducted in a peaceful and lawful manner, without causing any damage or injury.

- Inventory and Documentation:The repossession agent should carefully inventory the contents of the repossessed asset and document any damage or missing items. This documentation is important for legal purposes and to ensure the lender is aware of the condition of the asset at the time of repossession.

- Storage and Disposition:Once the asset is repossessed, the lender is responsible for storing it in a safe and secure location. The lender may then dispose of the asset through a public sale or other authorized methods.

Best Practices for Minimizing Legal Issues, Can a repo man go on private property

Repossession agents can minimize potential legal issues by following these best practices:

- Thorough Due Diligence:Before initiating repossession, repossession agents should conduct thorough due diligence to ensure they have the proper authorization and that the borrower is indeed in default. This includes verifying the loan agreement, confirming the borrower’s identity, and reviewing any applicable state laws.

- Clear Communication:Maintaining clear communication with the borrower throughout the repossession process is essential. This includes providing them with proper notice of default, explaining their rights, and answering any questions they may have. Effective communication can help avoid misunderstandings and potential legal disputes.

- Respect for Property Rights:Repossession agents must respect the borrower’s property rights. This includes obtaining permission to enter private property, avoiding unnecessary damage, and respecting the borrower’s privacy.

- Documentation and Evidence:Maintaining detailed documentation of the repossession process is crucial. This includes recording the date and time of the repossession, the location, the names of individuals present, and any communication with the borrower. This documentation can serve as evidence in the event of a legal challenge.

Actions to Avoid When Entering Private Property

Repossession agents should avoid the following actions when entering private property:

- Trespassing:Repossession agents should only enter private property with the owner’s consent or with a court order. Entering private property without permission can be considered trespassing and could result in legal action.

- Breaking and Entering:Repossession agents should not break into any building or structure to gain access to the asset. This can be considered a criminal offense and could result in serious consequences.

- Use of Force:Repossession agents should never use force or violence to gain possession of the asset. This includes threats, intimidation, or any physical altercation.

- Damage to Property:Repossession agents should avoid causing any damage to the borrower’s property, including the repossessed asset. Damage to property can lead to legal liability and additional costs for the lender.

Consequences of Unauthorized Entry

Repossession agents who enter private property without permission can face serious legal consequences. Unauthorized entry is a violation of property rights and can lead to civil lawsuits or criminal charges.

Civil Lawsuits

Civil lawsuits are common in cases of unauthorized entry during repossession. Property owners can sue repossession agents for trespass, conversion, and emotional distress. Trespass refers to the unauthorized entry onto someone’s property, conversion involves the unlawful taking or interference with someone’s property, and emotional distress can be claimed if the unauthorized entry caused emotional harm to the property owner.

Final Summary

Navigating the legal landscape of repossession on private property requires careful consideration of both property rights and the rights of repossession agents. Understanding the legal boundaries, potential consequences, and best practices can help all parties involved avoid unnecessary legal disputes.

Ultimately, the goal is to ensure that repossession is conducted legally and ethically, respecting the rights of both creditors and property owners.

Detailed FAQs

What happens if a repo man damages my property during repossession?

Repossession agents are generally liable for any damage they cause to your property. You can pursue legal action to recover damages, including repairs or replacement costs.

Can I prevent a repo man from entering my property?

While you can’t legally stop a repo man from repossessing your vehicle, you can request they wait until you’re present or at least contact you first. It’s important to document any attempts to contact the repo company or the repo agent.

What should I do if a repo man enters my property without permission?

If a repo man enters your property without your permission, you should document the incident, including the time, date, and any witnesses. You can also consider reporting the incident to the police and seeking legal advice.