Does credit acceptance repo cars – Does credit acceptance help you buy repo cars? This question often arises when people are looking for affordable vehicles, and repo cars seem like a tempting option. After all, they’re often priced lower than traditional used cars, but there’s a catch.

The credit acceptance process for repo cars is unique and requires a deeper understanding of the risks and benefits involved.

Repo cars, short for repossessed cars, are vehicles that have been taken back by lenders due to the owner’s failure to make payments. This means that these cars have a history, and their condition can vary widely. Credit Acceptance, a company that specializes in financing for individuals with less-than-perfect credit, has a role to play in this process.

They can help buyers secure financing for repo cars, but the approval process can be more stringent, and the interest rates might be higher than traditional loans.

Understanding Credit Acceptance and Repo Cars

Buying a car is a big decision, and sometimes getting financing can be a challenge. That’s where Credit Acceptance comes in, playing a crucial role in helping people with less-than-perfect credit get approved for auto loans. But what happens when things go wrong?

Enter repo cars, the unfortunate result of missed payments.

Credit Acceptance

Credit Acceptance Corporation (CACC) is a major player in the automotive finance industry. They specialize in helping people with subprime credit get approved for auto loans. They work with dealerships to provide financing options for individuals who might not qualify for traditional loans.

Repo Cars, Does credit acceptance repo cars

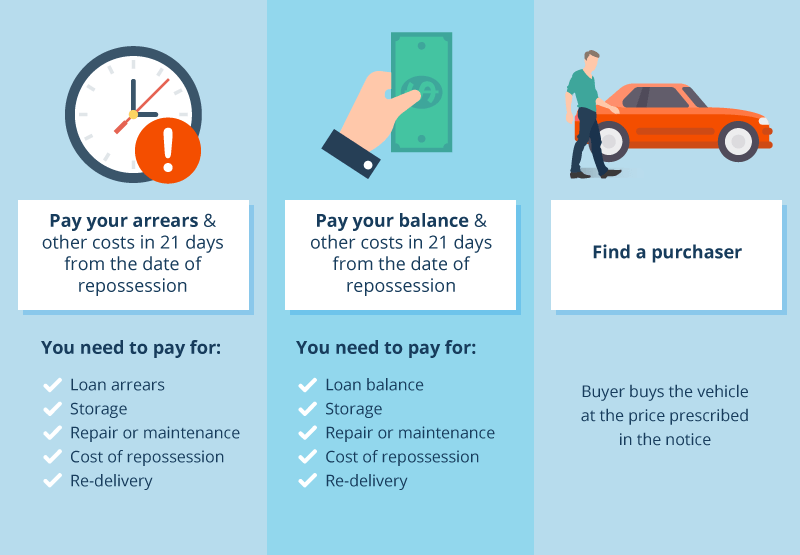

Repo cars, short for “repossessed cars,” are vehicles that have been taken back by the lender because the borrower has failed to make their loan payments as agreed. When a borrower defaults on their loan, the lender has the legal right to repossess the vehicle.

Reasons for Repossession

There are several common reasons why cars might be repossessed:

- Missed Payments:This is the most common reason for repossession. If a borrower misses several loan payments, the lender may initiate repossession proceedings.

- Financial Hardship:Unexpected events like job loss, illness, or a major life change can make it difficult to make loan payments, leading to repossession.

- Fraudulent Activity:In some cases, repossession may occur if the borrower provided false information on their loan application or engaged in fraudulent activity.

The Credit Acceptance Process for Repo Cars

Repo cars, also known as “repossessed vehicles,” are vehicles that have been taken back by lenders due to the borrower’s failure to make loan payments. Buying a repo car can be a great way to save money, but it’s important to understand the credit acceptance process involved.

The credit acceptance process for repo cars is similar to the process for buying any other used car, but there are some key differences. Lenders typically require a higher credit score for repo car buyers, and they may also require a larger down payment.

This is because repo cars are considered higher-risk investments due to their history of being repossessed.

Key Factors Considered During Credit Evaluation

Credit acceptance for repo cars is a comprehensive process that involves evaluating several factors. These factors are crucial in determining whether a buyer is eligible to purchase a repo car and the terms of the loan.

- Credit Score:A higher credit score is typically required for repo car buyers compared to those purchasing standard used cars. This is due to the higher risk associated with repossessed vehicles.

- Income:Lenders will assess your income to ensure you can afford the monthly payments. They will look at your income history and stability to determine your ability to repay the loan.

- Debt-to-Income Ratio:This ratio represents the percentage of your income that goes towards debt payments. A lower debt-to-income ratio is generally more favorable for loan approval.

- Down Payment:Lenders may require a larger down payment for repo cars to mitigate the risk associated with these vehicles. This can vary depending on the lender and the specific car.

- Credit History:Lenders will examine your credit history to assess your borrowing habits and past repayment performance. A history of late payments or defaults can negatively impact your chances of approval.

Documentation Required for Credit Acceptance

The necessary documentation for credit acceptance for repo cars can vary depending on the lender, but typically includes:

- Proof of Income:Pay stubs, tax returns, or bank statements can be used to verify your income.

- Proof of Residency:Utility bills, bank statements, or a driver’s license can serve as proof of your address.

- Social Security Number:This is required for credit checks and loan application processing.

- Driver’s License:A valid driver’s license is essential for vehicle registration and insurance purposes.

- Down Payment:A down payment may be required, and the amount can vary based on the lender and the vehicle.

- Bank Statements:These statements provide information about your financial activity and account balance.

Advantages and Disadvantages of Buying Repo Cars

Repo cars, also known as repossessed vehicles, can be an attractive option for budget-conscious car buyers. These vehicles are often sold at a significant discount compared to traditional used cars, offering a chance to get a good deal. However, buying a repo car comes with its own set of risks and considerations.

Potential Benefits of Buying Repo Cars

Repo cars often present a compelling opportunity for buyers seeking a bargain. The primary advantage lies in their lower prices, often significantly lower than traditional used car dealerships. This price difference stems from the fact that lenders often sell repossessed vehicles below market value to recoup their losses.

Another benefit is the wider selection available. Repo car auctions and dealerships typically offer a diverse range of vehicles, allowing buyers to choose from various makes, models, and years.

Potential Drawbacks of Buying Repo Cars

While repo cars offer potential savings, they also come with inherent risks. One significant concern is the possibility of hidden mechanical issues. Repo cars may have been driven by previous owners who neglected maintenance or even abused the vehicle. This can lead to unforeseen repair costs, which can quickly offset any initial savings.

Another drawback is the limited warranty coverage. Repo cars typically come with minimal or no warranty, unlike used cars from traditional dealerships. This means buyers are responsible for any repairs, potentially incurring significant expenses.

Comparison with Traditional Used Car Dealerships

Buying a repo car presents a different experience compared to purchasing from a traditional used car dealership. While repo cars offer lower prices, they often lack the same level of inspection and preparation as vehicles sold by dealerships. Dealerships typically have a more rigorous process for inspecting and reconditioning used cars, ensuring they meet certain quality standards.

Additionally, dealerships usually offer warranties, providing some protection against unexpected repairs.

Finding and Evaluating Repo Cars

Repo cars are a unique opportunity to purchase a vehicle at a potentially lower price than you’d find on the traditional car market. But, as with any used car purchase, it’s crucial to be cautious and thorough in your search and evaluation process.

This section will guide you through the process of finding and evaluating repo cars to ensure you make an informed decision.

Repo Car Sources

Repo cars are typically available from various sources, each with its own advantages and disadvantages. It’s important to understand the different avenues you can explore to find the right repo car for you.

- Auto Auction Websites:These websites, such as Copart, IAA, and ADESA, host online auctions where repo cars are frequently sold. You can find a wide range of vehicles at competitive prices, but you’ll need to be comfortable with the auction process and be prepared to bid against other buyers.

- Dealerships:Some dealerships specialize in selling repo cars. They typically have a selection of vehicles on their lot and may offer financing options. You can benefit from the convenience of dealing with a dealership, but you might pay a slightly higher price than at an auction.

- Private Sellers:Sometimes, repo cars are sold directly by individuals or companies who have taken possession of the vehicle after a loan default. You might find better deals with private sellers, but be cautious and ensure the vehicle’s history is clear.

- Repo Car Brokers:These companies specialize in connecting buyers with repo cars. They can offer a wider selection and may provide additional services like financing and vehicle inspections. However, be sure to compare their fees and services before engaging with a broker.

Evaluating Repo Cars

Before you commit to buying a repo car, take the time to thoroughly evaluate its condition, history, and price. This checklist will help you make a sound decision.

- Vehicle History Report:Obtain a vehicle history report from a reputable provider like Carfax or AutoCheck. This report can reveal details about the car’s past, including accidents, repairs, and ownership history. Look for any red flags that might indicate potential problems.

- Mechanical Inspection:It’s highly recommended to have a qualified mechanic inspect the vehicle before you purchase it. They can assess the engine, transmission, brakes, and other critical components for any issues that might need repair.

- Exterior and Interior Condition:Inspect the car’s exterior for any damage, dents, or scratches. Check the tires for wear and tear. Look for signs of water damage, mold, or mildew inside the car.

- Mileage and Maintenance Records:Review the car’s mileage and any available maintenance records. High mileage or a lack of regular maintenance could indicate potential problems.

- Price Comparison:Research the fair market value of the vehicle you’re considering. Compare prices from different sources to ensure you’re getting a good deal.

Negotiating Repo Car Prices

Repo cars are often priced below market value, but there’s still room for negotiation. Here are some tips to help you secure the best price:

- Research Market Value:Before you start negotiating, research the fair market value of the vehicle you’re interested in. This will give you a solid baseline for your negotiations.

- Highlight Flaws:If the vehicle has any flaws or issues, use them as leverage during your negotiations. Point out any cosmetic damage, mechanical problems, or other factors that might affect the car’s value.

- Be Prepared to Walk Away:Don’t be afraid to walk away from a deal if you’re not comfortable with the price. Remember, there are plenty of other repo cars available, and you don’t have to settle for the first one you see.

Financing Options for Repo Cars: Does Credit Acceptance Repo Cars

Repo cars, also known as repossessed vehicles, offer a unique opportunity to snag a decent car at a lower price. But before you get swept up in the excitement, it’s important to understand how financing works for these vehicles. Just like any other car purchase, you’ll need to secure a loan or lease to make it happen.

Loan Options for Repo Cars

Financing a repo car often requires a bit more scrutiny from lenders, as these vehicles might have a slightly higher risk factor. However, there are various loan options available for repo car buyers.

- Traditional Auto Loans:These are the most common financing options, offered by banks, credit unions, and online lenders. They provide fixed interest rates and fixed monthly payments for a set period.

- Subprime Auto Loans:These loans are designed for borrowers with lower credit scores, and they often come with higher interest rates and shorter loan terms. If you have a less-than-perfect credit history, this might be your best bet.

- Dealer Financing:Some dealerships offer financing options specifically for repo cars. This can be a convenient option, but it’s crucial to compare interest rates and terms with other lenders to ensure you’re getting the best deal.

Case Studies and Real-World Examples

Repo cars offer a unique opportunity to acquire vehicles at potentially discounted prices. However, understanding the risks and rewards involved is crucial for making informed decisions. Examining real-world examples of successful and unsuccessful repo car purchases provides valuable insights into the factors that contribute to positive or negative outcomes.

Successful Repo Car Purchases

Successful repo car purchases often involve careful planning, thorough research, and a willingness to take calculated risks. Here are some examples:

- The Savvy Investor:A seasoned car enthusiast with a knack for finding hidden gems in the repo market purchased a slightly used luxury sedan at a significantly discounted price. The car had minor cosmetic damage, which the buyer skillfully repaired, ultimately reselling the vehicle for a substantial profit.

- The Family-Oriented Buyer:A family looking for a reliable and affordable minivan found a well-maintained repo car that perfectly fit their needs. The vehicle had been repossessed due to the previous owner’s financial difficulties, but the car itself was in excellent condition. The family saved thousands of dollars compared to purchasing a new or used vehicle from a dealership.

- The Mechanic’s Dream:A skilled mechanic with a passion for restoring classic cars stumbled upon a repossessed vintage muscle car with significant potential. Recognizing the value of the vehicle, the mechanic invested time and resources to restore the car to its former glory, ultimately selling it for a handsome profit.

Unsuccessful Repo Car Purchases

Unsuccessful repo car purchases often result from inadequate research, overlooking hidden problems, or neglecting to consider potential risks. Here are some examples:

- The Blind Buy:A buyer purchased a repo car without conducting a thorough inspection, only to discover major mechanical issues after the purchase. The cost of repairs far exceeded the initial savings, turning the purchase into a financial burden.

- The Hidden Damage:A buyer purchased a repo car with a clean title history, unaware of previous accidents or repairs that had been concealed. The buyer later encountered recurring problems and faced costly repairs that overshadowed the initial savings.

- The Overlooked Risk:A buyer purchased a repo car without considering the potential risks associated with buying a vehicle with a history of financial distress. The buyer later discovered that the car had been involved in illegal activities, leading to legal complications and financial losses.

Final Summary

Buying a repo car can be a gamble, but it can also be a way to get a good deal on a vehicle. If you’re considering buying a repo car, it’s essential to do your research and understand the risks involved.

Make sure you have a pre-purchase inspection done by a qualified mechanic, and don’t be afraid to walk away from a deal if you’re not comfortable with the terms. Remember, credit acceptance can be a helpful tool for buying a repo car, but it’s not a magic bullet.

Do your due diligence, and you might just find the perfect car at a price you can afford.

FAQ Corner

What is a repo car?

A repo car is a vehicle that has been repossessed by a lender because the owner failed to make their payments. This means the lender took back ownership of the car.

Why would someone buy a repo car?

Repo cars are often sold at lower prices than traditional used cars, making them an attractive option for budget-conscious buyers.

What are the risks of buying a repo car?

Repo cars may have mechanical issues, limited warranties, or a history of neglect. It’s crucial to have a thorough inspection done before buying.

How does Credit Acceptance work with repo cars?

Credit Acceptance specializes in financing for individuals with less-than-perfect credit. They can help buyers secure loans for repo cars, but the approval process and interest rates may be more stringent than traditional loans.