Does a home warranty cover foundation repair? This question often arises when homeowners face unexpected foundation issues, hoping for financial relief. While a home warranty can provide protection for various home systems and appliances, the coverage of foundation repair is often a point of contention.

The extent of coverage depends on various factors, including the age of the home, pre-existing conditions, and the specific terms of the warranty contract. It’s essential to carefully review the fine print and understand the limitations and exclusions related to foundation repair coverage.

This guide will delve into the complexities of foundation repair coverage within home warranties, exploring the common types of coverage, the factors influencing coverage, and the importance of understanding the contract’s fine print. We’ll also discuss alternative options for financing foundation repairs, such as home equity loans and potential government assistance programs.

Home Warranty Basics

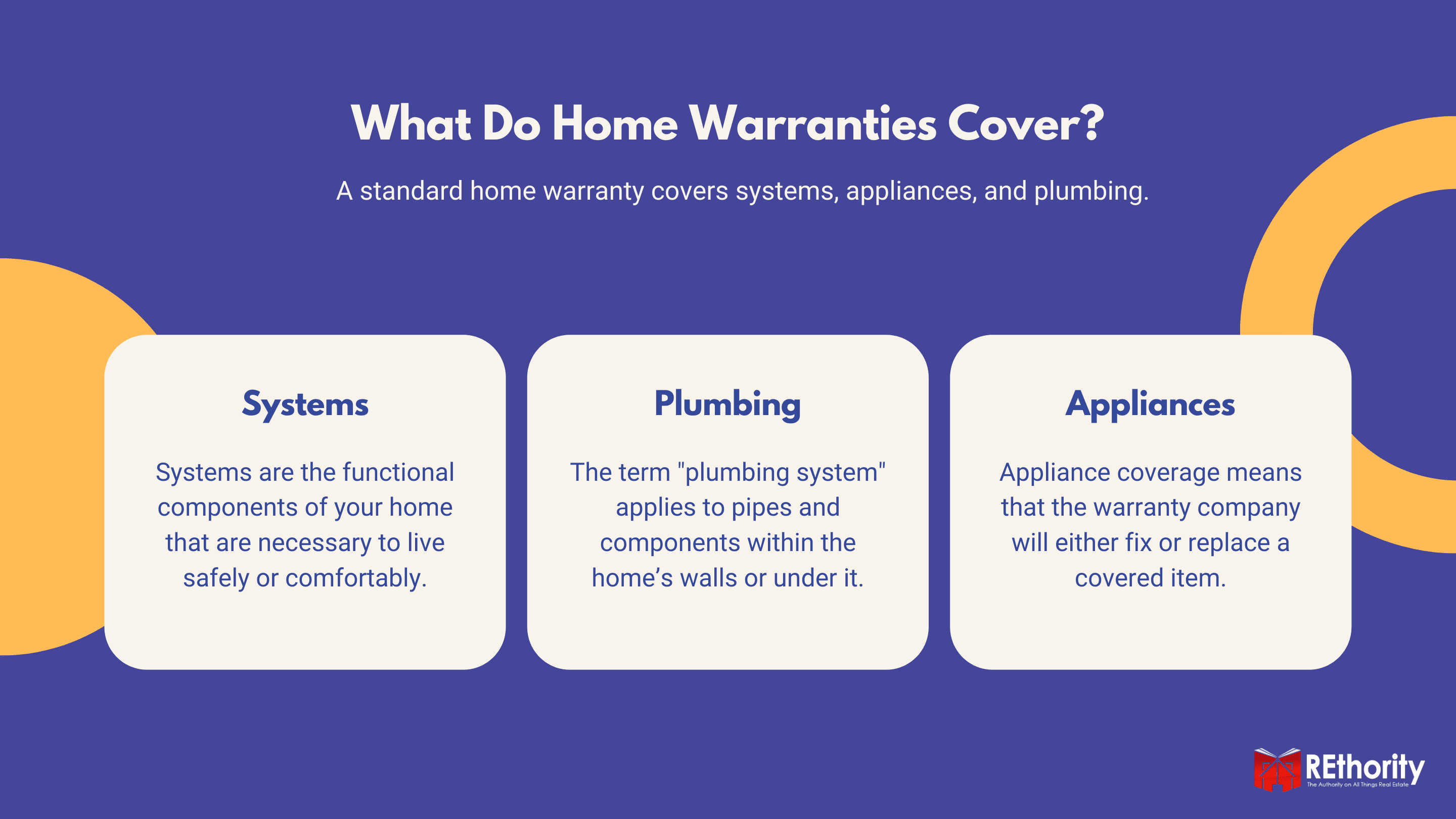

A home warranty is a contract that protects homeowners from the cost of repairs or replacements for specific appliances and systems in their home. It is a separate agreement from homeowners insurance, which covers damage from events like fire, theft, or natural disasters.

Home warranties are designed to provide peace of mind and financial protection against unexpected repair costs.

Types of Home Warranty Coverage, Does a home warranty cover foundation repair

Home warranties typically offer coverage for a variety of appliances and systems, with varying levels of coverage.

- Appliance Coverage: This includes items like refrigerators, ovens, dishwashers, washing machines, dryers, and garbage disposals.

- System Coverage: This may cover items such as heating and air conditioning systems, plumbing, electrical systems, and water heaters.

- Additional Coverage: Some home warranties offer additional coverage for items like roof leaks, ductwork, and well pumps. This is often available as an add-on or an upgrade to the basic plan.

Exclusions in Home Warranty Contracts

While home warranties offer protection against unexpected repair costs, they also have exclusions. These are situations or problems that are not covered by the warranty.

- Pre-existing Conditions: Many warranties exclude coverage for problems that existed before the contract was purchased. For example, if a refrigerator had a leak before the warranty was purchased, it may not be covered under the warranty.

- Normal Wear and Tear: Warranties typically do not cover routine maintenance or repairs for normal wear and tear. This might include things like replacing light bulbs or filters.

- Neglect or Abuse: Damage caused by negligence or abuse is typically not covered. For example, if a dishwasher is damaged due to improper use, the warranty may not cover the repair.

- Cosmetic Issues: Warranties usually do not cover cosmetic issues, such as scratches or dents, unless they affect the functionality of the appliance or system.

- Acts of God: Damage caused by natural disasters, such as floods, earthquakes, or tornadoes, is generally not covered by home warranties.

Foundation Repair Coverage

Home warranties are designed to protect homeowners from unexpected repair costs. While they often cover major systems like heating, cooling, and plumbing, foundation repair coverage can vary significantly. It’s crucial to understand what your home warranty covers and what it doesn’t.

Foundation Repair Coverage

Foundation issues can arise from various factors, including soil movement, poor drainage, and improper construction. Common foundation problems that may require repair include:

- Cracks in the foundation walls

- Bowing or leaning walls

- Sinking or settling floors

- Doors or windows that stick or are difficult to open

- Uneven floors or floors that slope

Situations Where Foundation Repair Might Be Covered

Home warranty coverage for foundation repair is often limited to specific situations. Here are some examples:

- Foundation cracks due to normal wear and tear:Many home warranties will cover minor foundation cracks that develop over time due to normal settling or expansion and contraction of the foundation. However, they may not cover cracks caused by severe weather events, earthquakes, or other catastrophic events.

- Foundation repairs due to drainage issues:If a home warranty covers plumbing and drainage, it might also cover foundation repairs caused by leaks or drainage problems. For instance, if a leaky pipe leads to water damage that weakens the foundation, repairs might be covered.

- Foundation repairs related to structural issues:Some home warranties may cover repairs related to structural issues that affect the foundation, such as a sagging roof or a collapsing wall. However, they might not cover repairs that are considered cosmetic, such as cracks in the foundation that do not compromise the structural integrity of the home.

Foundation Repair Coverage Variations

The specific coverage for foundation repair can vary significantly between different home warranty providers.

- Coverage limits:Some home warranties may have limits on the amount of coverage for foundation repairs. For example, a warranty might only cover up to $5,000 in repairs.

- Exclusions:Many home warranties have exclusions for certain types of foundation repairs, such as those caused by earthquakes, floods, or other natural disasters.

- Deductibles:Home warranties often have deductibles that homeowners are responsible for paying before the warranty coverage kicks in.

It’s important to carefully review the terms and conditions of any home warranty policy before purchasing it. This includes understanding the specific coverage for foundation repair and any limitations or exclusions that apply.

Factors Affecting Coverage

Home warranty coverage for foundation repair is influenced by several factors, including the age of the home, pre-existing conditions, and the specific terms of the warranty provider. Understanding these factors can help homeowners determine if foundation repair is covered and what limitations might apply.

Home Age

The age of a home is a significant factor in determining foundation repair coverage. Older homes are more likely to have foundation issues due to age-related deterioration. Some warranty providers may have age restrictions on coverage for foundation repair, especially for homes exceeding a certain age.

For instance, a warranty provider might not cover foundation repair for homes older than 30 years. Conversely, newer homes may have less risk of foundation problems, making them more likely to be covered under a warranty. However, it’s important to note that even newer homes can experience foundation issues due to factors like soil conditions or poor construction practices.

Pre-existing Conditions

Pre-existing conditions refer to any foundation issues that existed before the home warranty policy was purchased. These conditions are typically excluded from coverage, as they are considered pre-existing problems that are not covered by the warranty. For example, if a home has a history of foundation cracks or settling, a warranty provider may not cover these issues if they are not explicitly stated in the policy.

This means that if a homeowner knows about pre-existing foundation problems, they should disclose them to the warranty provider before purchasing a policy.

Coverage Variations

Different warranty providers offer varying levels of coverage for foundation repair. Some providers may offer comprehensive coverage for a wide range of foundation issues, while others may have more limited coverage. It’s crucial to compare policies from different providers to understand the specific coverage offered for foundation repair.

For instance, some warranties might cover foundation repairs related to cracking, settling, or shifting, while others might only cover repairs related to specific causes, such as water damage or tree root intrusion.

The Importance of Reading the Fine Print

.jpg/6849d0eb-2b3e-b624-da0b-a6e47b15287a?t=1609180492173)

A home warranty can offer valuable protection for your home’s systems and appliances, but it’s crucial to understand the specific terms and conditions of your contract, especially regarding foundation repair. This is because foundation repair is often a complex and expensive process, and your warranty may not cover all situations.

To ensure you have the coverage you need, you should carefully review your home warranty contract and understand the fine print. This includes examining the coverage limits, exclusions, and any specific requirements for filing a claim.

Key Terms and Conditions

Here are some key terms and conditions to look for in your home warranty contract regarding foundation repair:

- Coverage Limits:Most home warranties have limits on the amount they will pay for foundation repair. This limit may be expressed as a dollar amount or a percentage of the total repair cost. You should be aware of this limit and understand how it may affect your out-of-pocket expenses.

- Exclusions:Home warranties typically exclude certain types of foundation problems. Common exclusions include pre-existing conditions, foundation damage caused by natural disasters, or damage resulting from neglect or improper maintenance. Make sure you understand what is not covered by your warranty.

- Deductibles:Many home warranties have a deductible that you are responsible for paying before the warranty covers any repair costs. This deductible may vary depending on the specific plan you choose.

- Pre-Existing Conditions:If your foundation had any existing problems before you purchased the home warranty, they may not be covered. This is important to understand if you are buying a home with known foundation issues.

- Maintenance Requirements:Some home warranties may require you to perform specific maintenance tasks to keep your foundation in good condition. These tasks may include regular inspections or specific repairs. Failing to meet these requirements could invalidate your coverage.

- Approved Contractors:Home warranties may only allow you to use specific contractors for foundation repairs. You should confirm if your preferred contractor is approved by the warranty company.

Filing a Claim for Foundation Repair

If you believe you have a foundation repair issue covered by your home warranty, you will need to file a claim with the warranty company. Here is a general process for filing a claim:

- Contact the Warranty Company:The first step is to contact the warranty company and report the issue. You will need to provide details about the problem, including the location of the damage, the severity of the issue, and any relevant documentation.

- Inspection:The warranty company will likely send an inspector to assess the damage and determine if it is covered by your policy. The inspector will document the condition of your foundation and provide a report to the warranty company.

- Claim Approval:Once the warranty company receives the inspector’s report, they will review it and decide whether to approve your claim. If your claim is approved, the warranty company will provide you with a list of approved contractors for the repair.

- Repairs:You will need to schedule the repairs with an approved contractor. The warranty company will pay for the repairs up to the coverage limit and deductible.

Limitations and Exclusions

While home warranties can provide financial protection for foundation repair, it’s important to be aware of potential limitations and exclusions. Here are some common limitations:

- Coverage Limits:As mentioned earlier, most home warranties have coverage limits, which can limit the amount of financial assistance you receive for repairs.

- Exclusions:Home warranties often exclude coverage for certain types of foundation damage, such as pre-existing conditions, damage caused by natural disasters, or damage resulting from neglect or improper maintenance.

- Approved Contractors:You may be limited to using specific contractors approved by the warranty company, which could restrict your choice of repair professionals.

Understanding the limitations and exclusions of your home warranty contract is essential for making informed decisions about your coverage and managing your financial risks.

Alternatives to Home Warranties: Does A Home Warranty Cover Foundation Repair

While home warranties can offer peace of mind, they may not be the best option for everyone, especially when it comes to foundation repair. There are other financing options available that might be more suitable depending on your individual circumstances.

Home Equity Loans

Home equity loans can be a viable alternative to home warranties for financing foundation repair. These loans allow homeowners to borrow against the equity they’ve built up in their homes.

Benefits of Home Equity Loans

- Lower Interest Rates:Home equity loans often have lower interest rates than personal loans or credit cards, making them a more affordable option for financing major repairs.

- Tax Deductible Interest:The interest paid on home equity loans used for home improvements, including foundation repair, is typically tax-deductible up to a certain amount.

- Fixed Monthly Payments:Home equity loans typically have fixed monthly payments, which can help you budget for the cost of the repair.

Drawbacks of Home Equity Loans

- Risk of Foreclosure:If you default on your home equity loan payments, you could lose your home.

- Impact on Credit Score:A home equity loan can impact your credit score if you don’t make payments on time.

- Closing Costs:Home equity loans often have closing costs, which can add to the overall cost of the loan.

Government Assistance Programs

In some cases, government assistance programs may be available to help homeowners with foundation repair.

Potential Programs

- FEMA (Federal Emergency Management Agency):FEMA may provide financial assistance to homeowners who have suffered foundation damage due to natural disasters.

- HUD (U.S. Department of Housing and Urban Development):HUD offers a variety of programs to help low- and moderate-income homeowners with home repairs, including foundation repairs.

- State and Local Programs:Many states and local governments offer programs to assist homeowners with foundation repairs. These programs may be available to homeowners who meet certain income requirements or who live in designated areas.

Summary

Understanding the nuances of foundation repair coverage within a home warranty is crucial for homeowners seeking protection against unexpected expenses. While a home warranty can provide peace of mind for various home systems and appliances, it’s important to remember that foundation repair coverage is often limited or excluded altogether.

Thoroughly reading the contract, understanding the factors influencing coverage, and exploring alternative financing options can help homeowners make informed decisions and protect their investments.

Quick FAQs

What are some common foundation problems that may require repair?

Common foundation problems include cracks in the foundation, bowing walls, settling, and water damage.

How do I know if my home warranty covers foundation repair?

Review your home warranty contract carefully. The specific coverage for foundation repair will be Artikeld in the policy documents.

What are some alternative financing options for foundation repair?

Besides home equity loans, other financing options include personal loans, credit cards, and government assistance programs, depending on your eligibility.