When will Credit Acceptance repo your car? This question haunts many borrowers facing financial difficulties. Repossession, the lender’s legal right to reclaim a vehicle due to missed payments, is a serious matter with far-reaching consequences. Understanding the repo process, its triggers, and available alternatives is crucial for borrowers to protect their financial well-being.

Car repossession is a complex process involving legal steps and potential ramifications for borrowers. While lenders are obligated to follow specific procedures, the experience can be stressful and disruptive. This guide aims to shed light on the mechanics of repossession, its potential causes, and strategies to prevent or mitigate its impact.

Understanding the Repo Process

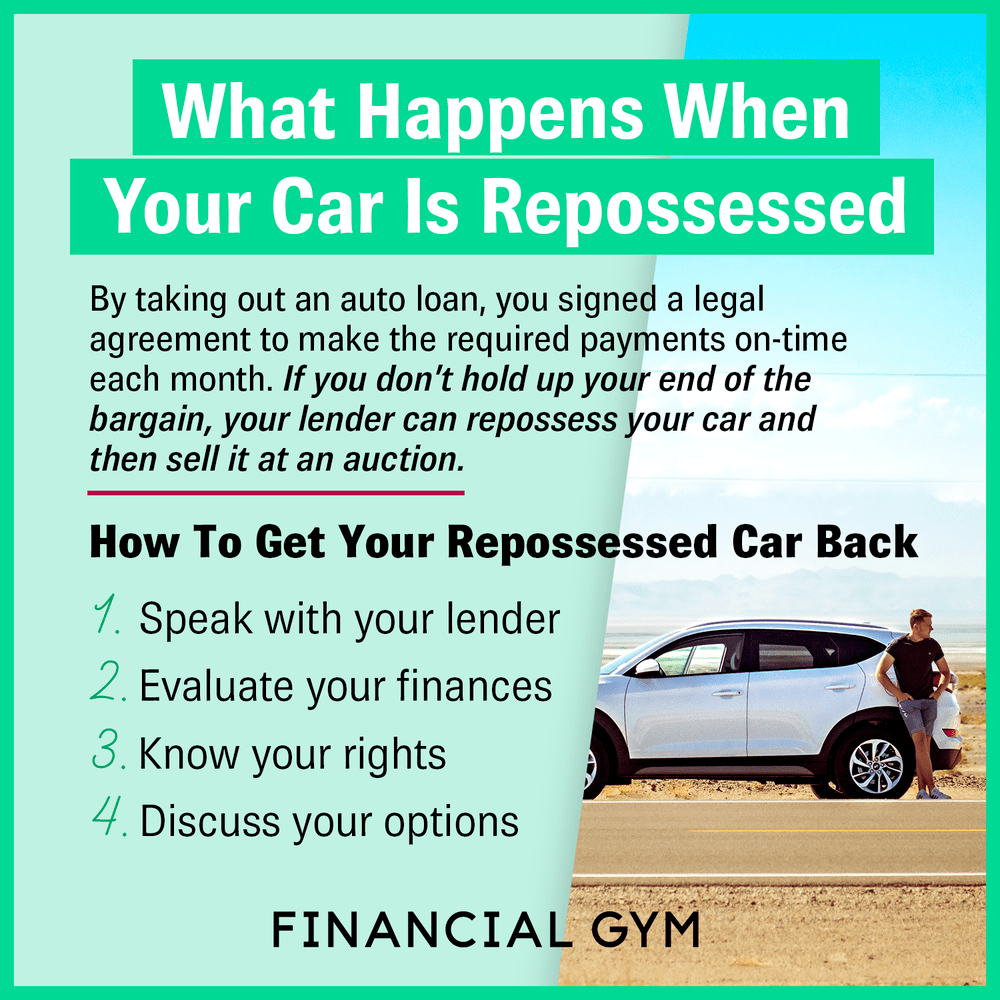

Repossession, often shortened to “repo,” is a legal process that allows a lender to take back a car when a borrower defaults on their loan payments. This happens when the borrower fails to meet the terms of the loan agreement, such as missing payments or exceeding the credit limit.

Understanding the repossession process, including the steps involved and the rights of borrowers, is crucial for anyone financing a vehicle.

Steps Involved in Repossession

The repossession process typically involves a series of steps, often initiated by the lender when a borrower defaults on their loan payments.

- Notice of Default:The lender typically sends a written notice to the borrower informing them of their default and the consequences of failing to make payments. This notice may include a grace period to cure the default.

- Repossession:If the borrower fails to cure the default within the grace period, the lender may initiate repossession. This usually involves a repossession agent hired by the lender to take possession of the vehicle.

- Sale of the Repossessed Vehicle:After repossessing the vehicle, the lender typically sells it at an auction. The proceeds from the sale are used to cover the outstanding loan balance, any related fees, and storage costs. Any remaining funds are typically returned to the borrower.

- Deficiency Balance:If the proceeds from the sale do not cover the entire outstanding loan balance, the lender may pursue the borrower for the remaining amount, known as a deficiency balance.

Borrower Rights During Repossession

Borrowers have certain legal rights during the repossession process, designed to protect them from unfair practices.

- Right to Notice:Borrowers have the right to receive notice of default from the lender, including the opportunity to cure the default.

- Right to Due Process:Borrowers have the right to due process, meaning they can challenge the repossession through legal means if they believe it was unlawful or unfair.

- Right to Redeem:Borrowers may have the right to redeem the vehicle by paying the full outstanding loan balance, including any accrued interest and fees.

- Right to Negotiate:Borrowers can attempt to negotiate with the lender to avoid repossession, such as by working out a payment plan or seeking a loan modification.

Factors Influencing Repossession

Repossession is a serious matter that can have significant financial and personal consequences. Understanding the factors that contribute to repossession can help borrowers avoid this situation and protect their financial well-being.

Late Payments

Late payments are a primary driver of repossession. When borrowers fail to make their car payments on time, they risk triggering a default on their loan agreement. Most car loan contracts have a grace period for late payments, but exceeding this period can lead to penalties and, ultimately, repossession.

- Late payment fees:Late payments often incur substantial fees, adding to the overall debt burden. These fees can quickly escalate, making it even more challenging to catch up on payments.

- Negative impact on credit score:Late payments negatively impact a borrower’s credit score, making it harder to obtain loans or credit in the future. This can affect other aspects of financial life, such as securing a mortgage or even renting an apartment.

- Increased risk of repossession:Repeated late payments signal to lenders that the borrower is struggling to manage their finances, increasing the likelihood of repossession.

Loan Terms

The terms of a car loan can significantly influence the risk of repossession.

- Interest rates:Higher interest rates can lead to larger monthly payments, making it more challenging for borrowers to keep up with their obligations. This can increase the risk of falling behind on payments and facing repossession.

- Loan length:Longer loan terms may seem appealing as they result in lower monthly payments. However, they often come with higher interest rates, leading to greater overall interest charges. The extended repayment period also increases the risk of unforeseen circumstances that could hinder the borrower’s ability to make payments, raising the likelihood of repossession.

Preventing Repossession

Repossession is a serious consequence of failing to meet loan obligations. While it can be a stressful experience, taking proactive steps to manage your finances and maintain a good credit history can significantly reduce the risk of having your car repossessed.

Maintaining Good Credit History

Maintaining a good credit history is crucial in preventing repossession. A strong credit score demonstrates your financial responsibility to lenders, making them more likely to approve loans and offer favorable terms. Conversely, a poor credit history can lead to higher interest rates, limited loan options, and increased risk of repossession.

- Pay Bills on Time:Timely payments are the cornerstone of a good credit score. Make sure to set reminders and prioritize bill payments to avoid late fees and negative marks on your credit report.

- Keep Credit Utilization Low:Credit utilization ratio is the percentage of your available credit you’re using. Aim to keep this ratio below 30% to avoid hurting your credit score. Regularly pay down balances to lower this ratio.

- Monitor Credit Report Regularly:Check your credit report at least annually for any errors or inaccuracies. Dispute any errors with the credit reporting agencies to ensure your credit score is accurate.

Managing Finances to Avoid Missed Payments

Effective financial management is key to preventing missed payments and the risk of repossession. By budgeting, tracking expenses, and prioritizing payments, you can avoid falling behind on your loan obligations.

- Create a Budget:Develop a realistic budget that Artikels your income and expenses. This helps you understand where your money goes and identify areas where you can cut back.

- Track Expenses:Keep track of your spending habits to ensure you’re staying within your budget. Utilize budgeting apps, spreadsheets, or other tools to monitor your expenses.

- Prioritize Loan Payments:Make loan payments a top priority in your budget. Consider setting up automatic payments to ensure timely payments and avoid late fees.

Legal Consequences of Repossession: When Will Credit Acceptance Repo Your Car

Repossession of a vehicle can have significant legal ramifications for the borrower. It’s not only about losing the car; it can have lasting effects on credit scores, future borrowing capabilities, and even legal actions from the lender. Understanding these consequences is crucial for borrowers facing potential repossession.

Impact on Credit Score

Repossession has a severe impact on your credit score, potentially lowering it by 100-150 points. This significant drop is due to several factors:

- Negative Account Status:Once the car is repossessed, the account is marked as “charged off” or “closed due to repossession” on your credit report. This indicates a missed payment history, which negatively affects your credit score.

- Collection Account:After repossession, the lender may sell the debt to a collection agency. This collection account is also reported on your credit report, further lowering your score.

- Debt-to-Credit Ratio:Repossession increases your debt-to-credit ratio, which is a crucial factor in credit scoring. This ratio reflects how much of your available credit you are using. A higher ratio generally results in a lower credit score.

Impact on Future Loan Applications

A lowered credit score due to repossession can significantly hinder your ability to obtain loans in the future. Lenders use credit scores to assess risk and determine interest rates. A low score indicates a higher risk of default, leading to:

- Higher Interest Rates:Lenders may charge higher interest rates on loans, increasing the overall cost of borrowing.

- Loan Denial:Lenders may deny your loan application altogether, as a low credit score signals a higher risk of default.

- Limited Loan Options:You may have limited access to loan products, especially those with favorable terms.

Potential Legal Action by Lender

While repossession itself is a legal process, the lender may take further legal action if the borrower owes a balance after the car is sold. This may include:

- Deficiency Judgment:If the sale proceeds from the repossessed vehicle are insufficient to cover the outstanding debt, the lender may seek a deficiency judgment against the borrower. This judgment obligates the borrower to pay the remaining balance.

- Wage Garnishment:In some cases, the lender may seek wage garnishment, which allows them to deduct a portion of the borrower’s wages to repay the debt.

- Bankruptcy:If the borrower is unable to repay the debt, they may consider filing for bankruptcy. This legal process can help alleviate financial burdens, but it has its own consequences.

Repossession Alternatives

Facing financial difficulties and struggling to keep up with car payments can be stressful, but it’s important to remember that repossession isn’t always the only option. Several alternatives can help borrowers avoid losing their vehicle.

Negotiating a Payment Plan, When will credit acceptance repo your car

When facing financial hardship, reaching out to your lender to discuss a payment plan is a crucial step in preventing repossession.

- Communicate with your lender:Contacting your lender as soon as you anticipate difficulty making payments is essential. Explain your situation clearly and honestly.

- Propose a plan:Work with your lender to create a payment plan that fits your current financial situation. This may involve temporarily reducing monthly payments, extending the loan term, or establishing a catch-up payment schedule.

- Document the agreement:Once you and your lender agree on a payment plan, ensure it’s documented in writing. This helps avoid misunderstandings and provides a record of the agreed-upon terms.

Selling the Car

If you can’t afford the car payments, selling the car may be a better option than facing repossession.

- Assess the car’s value:Determine the current market value of your car by researching online resources, consulting with a local dealership, or using a vehicle valuation tool.

- Find a buyer:Advertise your car for sale online, through classified ads, or by contacting local car dealerships.

- Pay off the loan:Once you’ve found a buyer, use the proceeds from the sale to pay off the remaining loan balance. If the sale price doesn’t cover the entire loan balance, you may be responsible for paying the difference.

End of Discussion

Navigating the complexities of car repossession requires knowledge, proactive planning, and potentially, legal counsel. By understanding the factors that contribute to repossession, the legal ramifications, and available alternatives, borrowers can take steps to protect their financial future. Remember, proactive communication with lenders and exploration of available options can often prevent the need for repossession and its associated consequences.

Expert Answers

What happens if I miss a payment on my car loan?

Missing a payment triggers late fees and can escalate the risk of repossession. Lenders typically have a grace period, but persistent late payments can lead to repossession proceedings.

Can I negotiate with the lender to avoid repossession?

Yes, you can attempt to negotiate a payment plan or explore alternative options like selling the car. Contact your lender immediately to discuss your situation and explore potential solutions.

What are the legal consequences of repossession?

Repossession negatively impacts your credit score, making it harder to secure loans in the future. It can also lead to legal action by the lender to recover any remaining debt.